Max Refund Guarantee

We are confident in our ability to maximize your tax refund and offer a Maximum Refund Guarantee to give you peace of mind.

Transparent Pricing

We offer fair and transparent pricing for our tax preparation services, with a detailed breakdown of costs available upon request.

Tax Professionals

All of our tax professionals are PTIN (Preparer Tax Identification Number) certified, which means that they have passed a comprehensive exam on federal tax law.

Individual

Basic Package Service

$ 199+

One Time Fee

Form 1040

State Returns

Audit Defense

Extensions are FREE

Fast Secure E-Filing Options

Email Support

Small Business

Pro Package Service

$ 349+

One Time Fee

Schedule C & K1's

Form 1065 Partnership

Form 1120S Corporate Return

C & S Corp Returns

State Returns

Schedule A

Audit Defense

Form 1065 & 1120S

Under 750k in Revenue

Fast Secure E-Filing Options

Email Support

Enterprise Business

Enterprise Package Service

$ 650+

One Time Fee

Over 750k in Revenue

Schedule C & K1's

Form 1065 Partnership

C & S Corp Returns

Form 1120S Corporate Return

Form 1065 & 1120S

Schedule A

State Returns

Audit Defense

Fast Secure E-Filing Options

Email Support

About Company

Your Tax Preparation Firm in Dallas, Texas

Our tax preparation firm is dedicated to providing high-quality, personalized service to our clients. With a team of experienced professionals and a commitment to staying up-to-date on the latest tax laws and regulations, we are well-equipped to handle all of your tax preparation needs. Whether you are an individual taxpayer or a small business owner, we are here to help you minimize your tax liability and make the tax preparation process as smooth and stress-free as possible.

Our Service

Tax Preparation Services in Dallas, Texas

Your partner in tax preparation success: accurate, reliable, and stress-free

Maximum Refund Guarantee*

We are confident in our ability to maximize your tax refund and offer a Maximum Refund Guarantee to give you peace of mind.

Fair & Transparent Pricing

We offer fair and transparent pricing for our tax preparation services, with a detailed breakdown of costs available upon request.

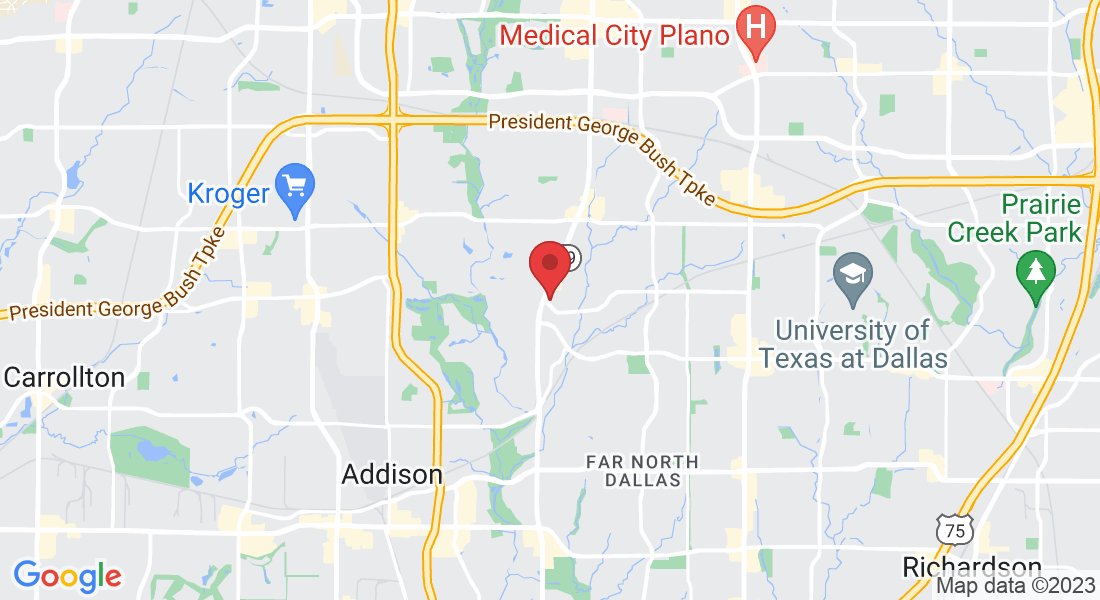

Based in Dallas, Texas

Our team of tax professionals is well-versed in the specific tax laws and regulations, ensuring that you receive the most accurate and up-to-date tax advice.

Tax Preparer Certified

All of our tax professionals are PTIN (Preparer Tax Identification Number) certified, which means that they have passed a comprehensive exam on federal tax law.

Personalized Service

We take a personalized approach to tax preparation, taking the time to understand your unique situation and needs.

Fast & Secure Online Filing Options

We offer fast and secure online filing options for your convenience, allowing us to efile your return so you can receive your refund electronically to your bank account.

Why Choose Us

Maximize Your Tax Refund

Come Meet Us at Our Dallas, TX Office

We offer flexible appointment times and are happy to answer any questions you may have about your taxes. We also offer fast and secure online filing options for your convenience.

Personalized 1-on-1 Service

We take a personalized approach to tax preparation, taking the time to understand your unique situation and needs.

Maximize Your Refund with Our Expertise

All of our tax professionals are PTIN certified, ensuring that they have the knowledge and expertise to accurately prepare your tax return.

Easy 3 Step Process

How it works

First Step

Second Step

Third Step

Tax Consultation

During our initial consultation, we will discuss your tax situation and answer any questions you may have. We will also provide you with a detailed estimate of the time and cost required to complete your tax return.

Paperwork Intake

Once you have decided to move forward with our services, we will begin the process of collecting all necessary paperwork and documentation to prepare your tax return.

Tax Filing & Refund

We will accurately prepare and file your tax return, ensuring that you receive all the deductions and credits you are entitled to. Once your return is filed, we will monitor the progress of your refund and keep you updated on its status.

Accurate, reliable, and stress-free tax preparation

Our tax preparation firm is dedicated to providing high-quality, personalized service to our clients. With a team of experienced professionals and a commitment to staying up-to-date on the latest tax laws and regulations, we are well-equipped to handle all of your tax preparation needs. Whether you are an individual taxpayer or a small business owner, we are here to help you minimize your tax liability and make the tax preparation process as smooth and stress-free as possible.

Choose Your Package

Tax Preparation Services

We offer a wide range of tax preparation services to meet the needs of our clients. Our services include tax return preparation, tax planning, representation before the IRS, and consulting, all designed to help you minimize your tax liability and ensure that you are in compliance with the law.

Individual

Basic Package Service

$ 199+

One Time Fee

Form 1040

State Returns

Audit Defense

Extensions are FREE

Fast Secure E-Filing Options

Email Support

Small Business

Pro Package Service

$ 349+

One Time Fee

Schedule C & K1's

Form 1065 Partnership

Form 1120S Corporate Return

C & S Corp Returns

State Returns

Schedule A

Audit Defense

Form 1065 & 1120S

Under 750k in Revenue

Fast Secure E-Filing Options

Email Support

Enterprise Business

Enterprise Package Service

$ 650+

One Time Fee

Over 750k in Revenue

Schedule C & K1's

Form 1065 Partnership

C & S Corp Returns

Form 1120S Corporate Return

Form 1065 & 1120S

Schedule A

State Returns

Audit Defense

Fast Secure E-Filing Options

Email Support

Testimonial

Our Clients Reviews

FAQ

Frequently Ask Questions.

As a CPA from with a MBA and staff that is all PTIN certified, we receive a variety of questions from our clients on a range of topics. Some common questions we receive include:

Are you certified or registered with the IRS?

As a CPA at AG Freideman, I am proud to say that I am both certified and registered with the IRS.

As a Certified Public Accountant, I have met the educational, experience, and examination requirements set forth by the state in which I am licensed. This includes passing the Uniform CPA Examination, which is administered by the American Institute of Certified Public Accountants (AICPA).

In addition to my CPA license, I am also an Enrolled Agent, which means that I am authorized to represent taxpayers before the IRS. I have passed a comprehensive exam on federal tax law and am required to complete continuing education every year to maintain my enrollment.

As a professional tax preparer, I am also required to have a PTIN (Preparer Tax Identification Number). This allows me to prepare federal tax returns for a fee and ensures that I am held to the highest ethical standards in the industry.

I take great pride in my professional qualifications and strive to provide top-quality tax preparation services to my clients.

How long have you or your business been doing taxes?

As a CPA from a tax firm, I have been preparing taxes for many years. I have a deep understanding of the tax code and am well-versed in the latest tax laws and regulations.

In addition to my personal experience, our tax firm has been in business for more than many years. During this time, we have helped thousands of individuals and businesses navigate the complex world of taxes and ensure that they are in compliance with the law.

We have a team of dedicated professionals with a wide range of expertise, including tax preparation, tax planning, and tax representation. Our goal is to provide high-quality, personalized service to each and every one of our clients.

Whether you are an individual taxpayer or a small business owner, we are here to help you minimize your tax liability and make the tax preparation process as smooth and stress-free as possible.

Will you provide references?

I would be happy to provide references upon request.

I take pride in the high-quality tax preparation services that I and my team provide, and I am confident that our clients will be able to speak to the level of expertise and professionalism that we bring to every engagement.

If you would like to speak with one or more of our clients to get a better understanding of our work, please let me know and I will be happy to provide you with a list of references. I believe that the best way to gauge the quality of our services is to hear directly from those who have experienced them firsthand.

I look forward to the opportunity to serve you and demonstrate the value that our firm can bring to your tax preparation needs.

What is your education level?

I hold a Master's degree in Business Administration in addition to my CPA license. I have been practicing as a CPA for over 20 years and have a deep understanding of tax law and accounting principles.

In addition to my own education and experience, I am fortunate to have a team of highly qualified professionals working with me at our firm. All of our staff members are PTIN (Preparer Tax Identification Number) certified, which means that they have passed a comprehensive exam on federal tax law and are required to complete continuing education every year to maintain their certification.

We believe that education and professional development are critical to providing the highest level of service to our clients. We are committed to staying up-to-date on the latest tax laws and regulations and to continuously improving our skills and knowledge in order to better serve our clients.

I am confident that the combination of my own education and experience, as well as the expertise of my staff, make our firm uniquely qualified to handle your tax preparation needs.

Can I contact you anytime?

I and my team are committed to being accessible to our clients whenever they need us.

We understand that tax-related questions and issues can arise at any time, and we are here to provide the support and guidance you need.

If you have a question or concern about your taxes, you can feel free to contact us anytime. We have a dedicated team in place to handle inquiries and ensure that you receive a timely response.

Whether you have a question about your tax return, need assistance with a tax issue, or simply want to discuss your tax planning strategy, we are here to help.

Please don't hesitate to reach out to us anytime. We look forward to the opportunity to serve you.

Do you offer a guarantee on your work?

We are confident in the quality of our work and are happy to offer a guarantee on our services.

We understand that preparing your taxes can be a complex and stressful process, and we want to give you the peace of mind that comes from knowing that you are in good hands.

If you are not satisfied with the work we have done for you, or if you experience any issues with the accuracy or completeness of your tax return, we will work with you to resolve the matter to your satisfaction.

Our goal is to provide top-quality tax preparation services to our clients and to ensure that they are completely satisfied with the work we do.

If you have any concerns or questions about our services, please don't hesitate to let us know. We are here to help.

Do you post your pricing?

we understand that price is an important consideration for our clients when choosing a tax preparation service.

We are happy to provide a detailed breakdown of our pricing for our various services, including tax return preparation, tax planning, and representation before the IRS.

Our pricing is based on a variety of factors, including the complexity of your tax situation, the amount of time and effort required to complete your tax return, and any special requests or needs you may have.

We are committed to providing transparent and fair pricing to our clients and will work with you to determine the best course of action for your specific needs.

If you would like more information on our pricing, please don't hesitate to reach out to us. We will be happy to provide you with a detailed quote and discuss your options with you.

Office: 17304 Preston Rd Ste 861, Dallas, TX 75252

Call (972) 893-3481

Email:inquries@agfreideman.com

Site: www.agfredieman.com

Copyright 2023 . All rights reserved

Privacy Policy & Terms and Conditions

This site is not part of, or endorsed by, Facebook™, Google™, Snapchat™, Twitter™ or any social media platform in any way.

All product names, logos, and brands are property of their respective owners. All company, product and service names used in this website are for identification purposes only. Use of these names, logos, and brands does not imply endorsement.

FACEBOOK™ is a trademark of FACEBOOK, Inc. YOUTUBE™ and GOOGLE™ are trademarks of GOOGLE™, LLC. SNAPCHAT™ is a trademark of SNAP™, Inc. TWITTER™ is a trademark of TWITTER™, Inc.

AG Freideman Tax Preparation Firm

17304 Preston Road Ste 861

Dallas, Texas 75252